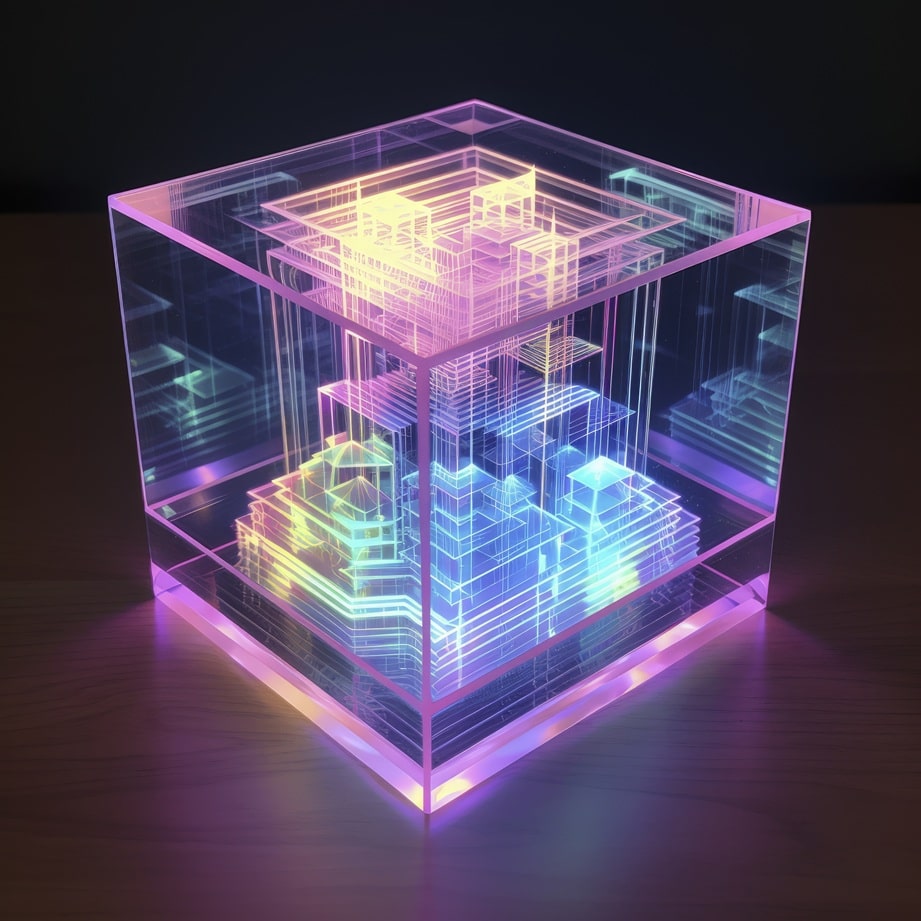

Core-lending and

core-leasing platform

core-leasing platform

Designed to power your entire credit lifecycle – from origination to collections – with speed, flexibility, and full automation.

The only 100% API low-code digital-native platform with proven built-in business expertise.

We are 100% API

Connect instantly with any system, internal or third-party

We are modular

Activate only the components you need

We are cloud-native

Scalable, secure, and future-proof

We are fast

Agile implementation for record delivery time

We are compliant

GDPR, DORA, and any other acronym you can think of

Our platform covers

Origination

Digital onboarding, custom rules,

document capture, external data checks

Decisioning

e-KYC/KYB, scoring engine

instant approval workflows

Contracting

E-signature, schedule simulation,

automated contract generation

Servicing

Payment tracking, restructuring,

early settlement

Collections

Dyamic alerts, configurable dunning,

multi-channel recovery

Reporting

Real-time booking & accounting KPIs,

multi-GAAP & IFRS regulatory compliance

Start fast. Scale without limits.

Ready to transform your financing operations? Our experts can show you how in 30 minutes.

Your tech. Your rules.

Forget vendor lock-in. Basikon adapts to you to reach your goals – no matter the route. Do you want us to implement the system for you, tailor it yourself, or work with a trusted partner? Our modular and microservice architecture plugs seamlessly into your ecosystem, whether you are building from scratch or enhancing a legacy stack.

Our open architecture lets you connect to any system.

No restriction, no friction, only action.

Real results for modern lenders

"Basikon enabled us to go from zero to a fully operational credit platform in less than six months. We didn’t just need software – we needed control, automation, and the ability to act quickly."

Ignacio Sánchez Cervigón, CEO of Flexicar Renting

Real results for modern lenders

"Thanks to Basikon, Glinche successfully transformed its operations, moving from manual and time-consuming processes to a fully automated and scalable system."

Christophe Glinche, Director at Glinche Automobiles

Real results for modern lenders

"Basikon’s highly configurable solution – supported by the team’s deep business expertise, iterative approach, and problem-solving mindset – enabled us to launch our leasing business in just four months without compromise."

Matthies Haentjens, Head of Business Development at FinancialLease

Real results for modern lenders

"Basikon enables Sofliz to easily manage a large number of customers and partners in a reliable and secure way. This will allow us to grow our business faster, without being slowed down by technical constraints."

Arnaud Bazin, CEO of Solfiz

Customer

success stories

success stories